A Reverse Mortgage could make all the difference for you!

Find Out In Just A Few Easy Steps If A Reverse Mortgage Is Right For You

Find Out In Just A Few Easy Steps If A Reverse Mortgage Is Right For You

ABOUT US

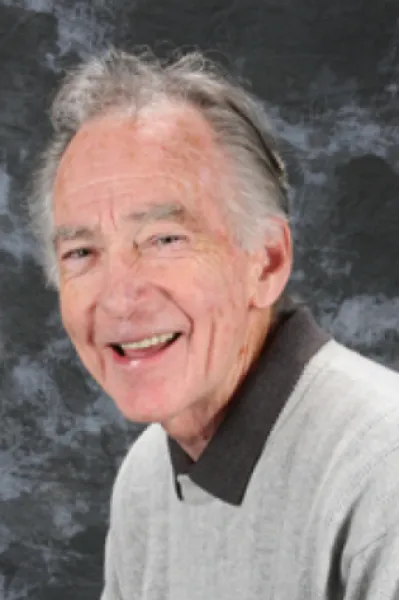

I’m Owen Coyle and I've been setting up Reverse Mortgages for over 24 years. I do business “The Old Fashion Way”. I go to the seniors’ home and sit down with them at their kitchen table and talk with them “Face to Face”. I make sure that I answer all their questions and that the entire family understands how the Reverse Mortgage works.

CONTACT US

(760) 334-6155

20 Truman St Suite 205

Irvine, CA 92620

Serving all of San Diego County

LICENSING INFO

NMLS #279015 | DRE #01253295

Reverse Mortgage West:

NMLS #274336 | DRE #01837820

This material is not provided by, nor was it approved by the Department of Housing & Urban Development (HUD) or by the Federal Housing Administration (FHA). It is not intended to be a substitute for legal, tax or financial advice. Consult with a qualified attorney, accountant or financial advisor for additional legal or tax advice.

*For the FHA-insured Home Equity Conversion Mortgage (HECM) reverse mortgage

**There are some circumstances that will cause the loan to mature and the balance to become due and payable. The borrower(s) must continue to pay for property taxes and insurance and maintain the property to meet HUD standards or risk default. Credit is subject to age, minimum income guidelines, credit history, and property qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.